Do you have a 401(k), 403(b), IRA, Mutual Fund, Stocks, Bonds or other Investments whether they are for Retirement, College Funding, General Savings, there are things that Wall Street and the Mutual Fund Companies Do Not Want You to Know!

The Mutual Fund Companies and Wall Street only want you to see Average Returns, not the actual returns you make, there can be a very big difference.

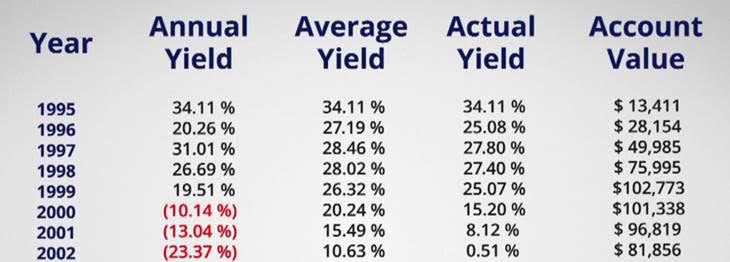

If you put in $10,000 a year into the S&P 500 from 1995 to 2002 you would have an average return of 10.63%

If you add up all the returns you get 85.03% and Divide that by 8, you will have an average return of 10.63%. If you actually made 10.63% on your deposits you would have grown to: $129,446. The important thing is what did you actually make with your $10,000 deposits for 8 years?

Check out the difference between the Average Rate of Return vs. the Real Rate of Return

Your $80,000 in deposits would be worth only $81,856 because of the negative last 3 years wiping out the gains of the first 5 years, which was a record 5 year period. The mutual fund companies and Wall Street would stress you averaged over 10% even though you actually didn’t even earn 1%.

Actual Returns Differ from Average Returns

The Average Return you see reported would be 10.63% even though you didn’t come close to making that, in fact you made less than 1.00%

The Regulators, Wall Street and the Mutual Fund Companies are fine saying you Averaged over 10% even though you actually made less than 1%

If you think Wall Street and the Mutual Fund Companies are misleading you, then you are correct and getting bad advice.

The Regulators, Wall Street and the Mutual Fund Companies are fine saying you Averaged over 10% even though you actually made less than 1%

If you think Wall Street and the Mutual Fund Companies are misleading you, then you are correct and getting bad advice.

Chart shows deposits annually of $10,000

Ken Olshein is a fully independent financial advisor with over 25 years’ experience offering his clients the best service and products available. Unlike many advisors out there who work for large firms, they are captive and can only offer what their employer allows them to sell (many times this the best product for their clients). The financial service field is a constantly changing industry in which larger firms can change fast enough to offer the very best to their clients. The last few years Ken has focused on helping employees of the United States Federal Government. Seminars, Webinars, on site consulting, off site and phone consulting is now available for Federal Employees.

Ken Olshein is a fully independent financial advisor with over 25 years’ experience offering his clients the best service and products available. Unlike many advisors out there who work for large firms, they are captive and can only offer what their employer allows them to sell (many times this the best product for their clients). The financial service field is a constantly changing industry in which larger firms can change fast enough to offer the very best to their clients. The last few years Ken has focused on helping employees of the United States Federal Government. Seminars, Webinars, on site consulting, off site and phone consulting is now available for Federal Employees.

Can you answer these four questions regarding your retirement savings?

- 1. When do you plan on retiring?

- 2. What will your funds be worth at that time?

- 3. How much Guaranteed Lifetime Income will they provide at retirement?

- 4. Would you like to find out what type of Income you could plan on during retirement?

If you work for the Federal Government be sure to find out about the TSP Navigator, your free benefits and retirement report and the best way to maximize your employee retirement benefits. Ken strives to help his clients reduce risk while still getting great returns and offering a way to guarantee your retirement income for life. Also available are disability, long term care and life insurance many with unique features and benefits other brokers are not offering; Guarantee Issue Short Term Disability for Federal Employees with payroll deduction, Life Insurance that pays benefits for a critical illness such as a heart attack, stroke, cancer, severe accident and offer options to get all your money back if you never need the coverage also available through payroll deduction for Federal Employees. Ken is licensed in several states and can offer products and services in most others. Call to find out more.