3 Things can Happen with Your Retirement

There are basically 3 things that can happen with your Money while in the Market; it can go up, go down or stay flat. Two out of Three are bad and will cause you to run out of money in Retirement, let IMG show you how to get the upside potential of the Market while avoiding the downside with the option of Guaranteed Lifetime Income! Whether you are retired now or will retire in 20 years you can add guarantees that will make sure you never lose money in the market and have a predictable and reliable Retirement Income at the time of your choosing, what could be better?

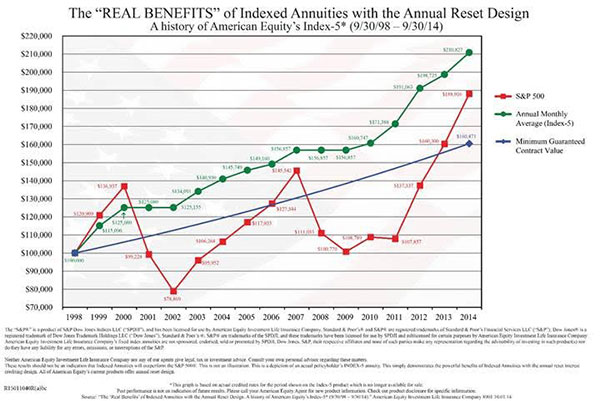

There is one financial product out there that can give you the upside of the market while avoiding the downside and could very likely outperform being in the market. You can get all of this protection from Market Losses with the Upside of the Market, Lock in Your Gains, be able to outperform Mutual Funds and other Stock Market Investments with No Fees! Currently you are able to lock in over 70% of the S&P 500 Index while avoiding any downturns in the market, here is an example of how it could work for you. The graph below is an example of an Index Annuity issued back in 1998, you notice when the market goes up the annuity value goes up, when the market goes down the annuity stays level. By avoiding the big drops of the market, this annuity has outperformed the S&P 500. This is just one example of how an annuity can outperform the market.

There are Index annuities that credit interest based on many different Indices and new ones are being developed all the time, so you should only work with an Index Expert when purchasing an Index annuity. Some annuities have optional Income Riders that will Guarantee you and your spouse a Guaranteed Lifetime Income at the time of your choosing, it is like your own private pension. So if you are 15 years or fewer to Retirement you can lock in a Guaranteed Income Now and not have to worry about what happens if the market is Flat or Negative. No matter what happens your money is safe and you can have a guaranteed lifetime income that you can count on when you retire.

Many people do not realize there is a Safer Place for their Money than in a Mutual Fund, Stock, Bond, EFT, Variable Annuity, 401(k), 403(b), 457 plan, these plans have fees, risk and uncertainty. Olshein Asset Advisors specializes in helping their clients avoid market risks, reduce fees and put some Guarantees in their Retirement Plans! A Great Majority of Americans are taking too much RISK with their money and not getting an appropriate return.

The goal of Wall Street and the Mutual Fund Companies is to have you take all the Investment Risk and Pay Them Fees to Manage your Investments. They spend Billions marketing this concept, hire spokes people to pitch this to everyone. Your 401(k) funds are invested in Mutual Fund subaccounts, 529 Plans, the same thing, Variable Annuities as well. With Trillions of dollars under management in Mutual Funds, Exchange Traded Funds (ETF) collect fees while you take on the Risk of the Stock Market. Many times the ordinary investor is paying fees to several different organizations along with operating costs, even marketing costs. These fees can add up a typical Mutual Fund could be 2-3%, same with your 401(k) sometimes your broker will add an additional 1-2% in fees to manage your money. The market since the beginning of 2000 has only returned 4 to 5% before fees so after fees there is not much left for you is there? You are conditioned to accept paying fees along with taking risk in the market, they tell you losing money is normal and that the market is the best place to be in the long run. First of all the market has had two major corrections of 50% since 2000 most investors were lucky to average 3% during that time so I don’t believe the Market is the Best Place to be. There are better places to put your Money where you get some Guarantees that you will not lose anything if the market goes down and you can still make a very good reasonable rate of return.

Now there is nothing wrong with paying fees if you get some value for doing so, however in most cases people have no idea what they are paying for in fees, who they are paying them to and what value they are getting for their money. Don’t forget there are no Guarantees provided with all the fees and the investor holds all the Risk of Investment Losses, Defaults, Under Performance and so on. All you are doing is paying people and firms to push around paper and being held hostage to the market whims, gains and losses.

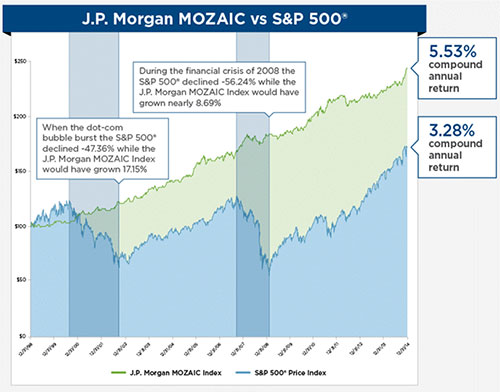

There is a Better Way! The last 20 years there have been new financial instruments that move the risk away from you and offer different types of Guarantees and Tax Savings. In simple terms the investor or saver receives interest credited by how on the upside of an Index and none of the downside of the Index Losses. In many cases the Index Strategy out performs the Market, here is an example of just one index outperforming the Market of a new Index from J.P. Morgan0

Past Performance does not Guarantee future Results