The Greatest Threat to Retirement Income is: The Sequence of Returns

And very few know about it.

Before we go over the Sequence of Returns, one must first understand how much is needed to get an account back to even after an investment loss and how long it takes. Did you realize how much you need to earn after a loss?

If You Lost You Need To Earn |

|

10% 11.11% |

|

20% 25.00% |

|

30% 42.86% |

|

40% 66.67% |

|

50% 100.00% |

|

60% 150.00% |

|

70% 233.33% |

|

80% 400.00% |

|

90% 900.00% |

|

99% 9,900% |

Has your broker or advisor explained to you that you need to make back 42.86% after you loss 30% to just get back to even?

Did your broker or adviser explain to you how long it will take to make up losses if you are making; 3%, 6% or 8%?

If you lost this much in the market: IT could take this many years to rebuild your nest egg! @ a 3% return @ a 6% return @ a 8% return |

10% 3.6 Years 1.8 Years 1.3 Years |

20% 7.5 3.7 2.9 |

30% 12 6 4.6 |

40% 17 8.6 6.6 |

50% 23.2 11.6 9 |

If your advisor didn’t explain this to you, I am sure he or she never explained the Sequence of Return Risk. DEFINITION of 'Sequence Risk '

The risk of receiving lower or negative returns early in a period when withdrawals are made from the underlying investments. The order or the sequence of investment returns is a primary concern for those individuals who are retired and living off the income and capital of their investments.

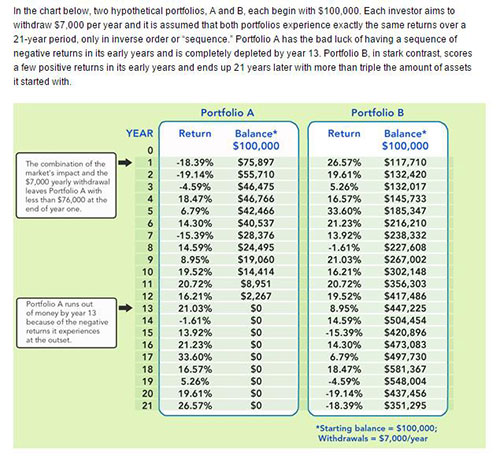

Here is one example for education proposes only

By simply reversing the order of returns causes one account to run out of money while the other account does well, this is not an actual investment

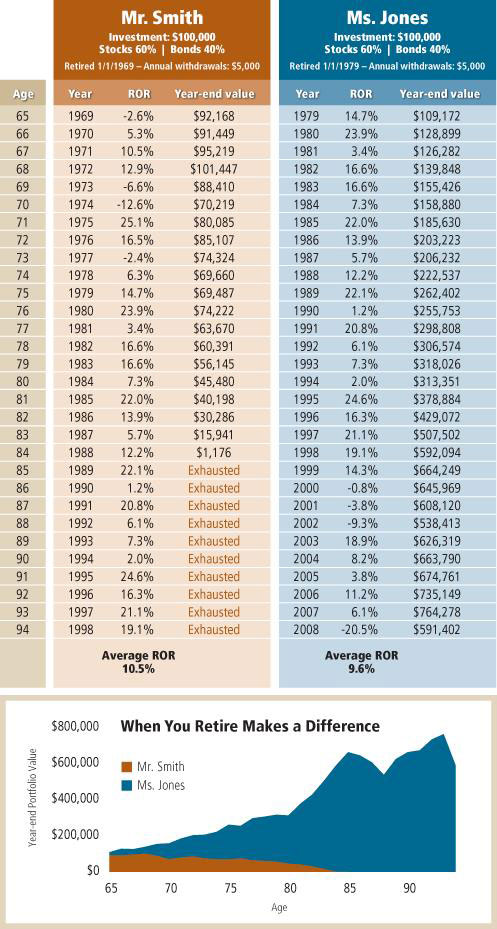

Here is another example of timing and sequence of return risk, Mr. Smith retired in 1969 and ended up running out of money, Ms. Jones retired 10 years later and did very well because she had good returns early on.

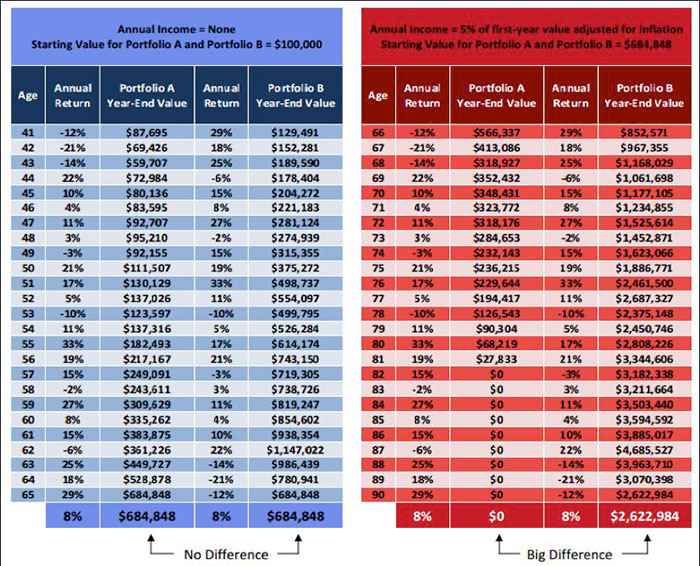

Another Hypothetical Example show that the while you are growing your money the Sequence of Return has no bearing on the outcome, however when you are taking money from your investment account it has a great bearing on the outcome. If your advisor has failed to explain this to you then they are doing you a great dis-service.

It is important to note that when you are taking money from your Retirement account it is most imperative to have positive gains early on or you run the risk of running out of money. Please contact us if you do not understand the Sequence of Return Risk or if you would like to avoid it in your Retirement.

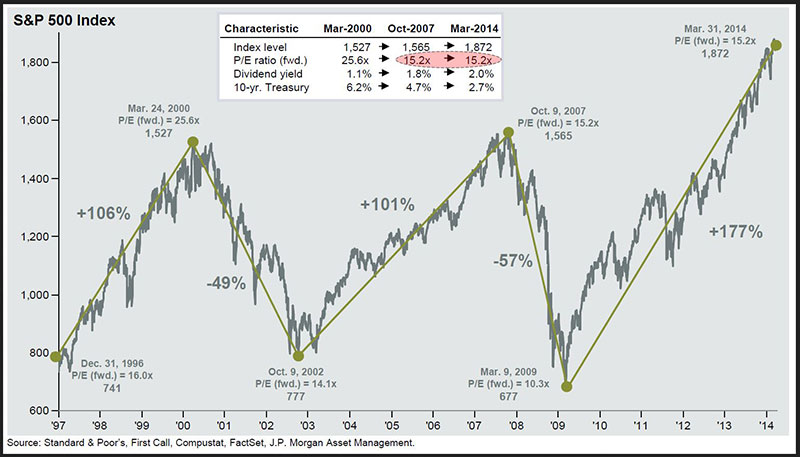

A little more bad news, currently the market is at or close to its all-time highs, so the odds of having positive gains vs. negative returns is low. So if you feel that the market could come down soon, you should do something to protect your gains and protect against future downturns in the market by using an Index Strategy.

Look how volatile the market has been since 1998 and we are close to or at record highs, so it would seem a big downturn could happen soon.

Having your Money in an Index Strategy will protect you against an up and down market and many times you will be able outperform an investment in the Stock Market. So don’t listen to them when they say the Stock Market outperforms everything, that buy and hold is the best strategy, that everyone pays fees or that everyone loses in the market. You can avoid losses and fees with an Index Annuity. You can create a nice Tax Free Retirement without market risk with Index Life.

At Olshein Asset Advisors we don’t want to manage all your money, just the money you want to keep safe, the money you want to avoid market losses and we can help you with a Tax Free Retirement that can provide you up to 50% more income. Contact us for more information.