Tax Free Retirement

Also if you are like many Americans who use a Qualified Plan to save for Retirement you will be subject to Income Taxes, usually you will pay 10 times more in Taxes then you save while putting money away during your working years. Just because Wall Street and the Mutual Fund Companies recommend this doesn’t make it your best option. For example; let’s say you put away $1,000 a month in a 401(k) or similar plan and you get a tax deduction of $200 each month so over a 25 year period you saved $60,000 in taxes. Now if you earned a return of 9% net of any fees you would have $1,121,121 in your account now during retirement you take out 7% ($78,478) from your account to be more conservative and you are still in a 20% tax rate so you pay $15,700 in taxes each year. In less than four years you have paid more in taxes than you saved over the last 25 years. Now you have to worry about market losses and running out of money and subject to increasing taxes from the government and means testing for your social security and Medicare benefits. (See sequence of return risk)

There is a much better way for most Americans. Now what if you instead of doing what everyone else is doing with a 401(k) and you used after tax dollars of $800 a month and put into a properly funded Tax Free Plan, you would be able to take out $100,000 a Tax Free at Retirement; without Market Risk and having your benefits means tested, wouldn’t that be better? In addition you could have access to that money before 591/2 without penalty, you could put more in if you wanted, skip a year, use the funds for a child’s college, invest in Real Estate or a Business like Walt Disney did with his Tax Free Plan. So you have much less risk, save more in taxes, could have 50% more retirement income, more flexibility and you keep the IRS out of your finances. Which is better for you, what provides more after tax income, has less risk and more flexibility?

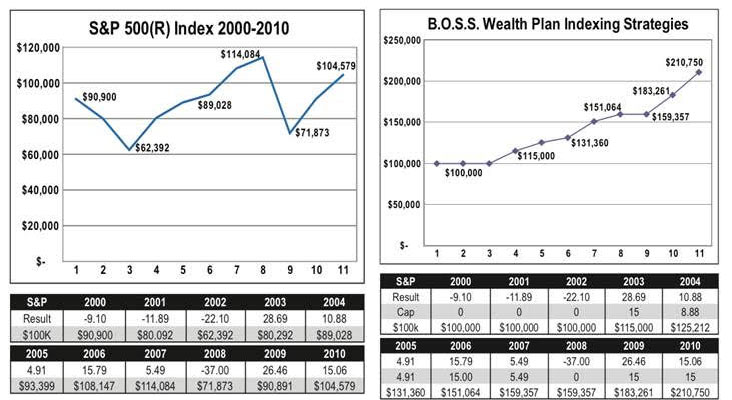

You can still use this strategy of a Tax Free Income even if you are in your 60’s and have already saved up for retirement in your 401(k) or other type of retirement plan. It is similar to a Roth Conversion but it is done over a period of years; 3 to 7 and there is a way to avoid having to come out of pocket to pay the income tax due during the conversion. You still can retire tax free and have up to 50% more income to live on and you will protect yourself against increasing tax rates and means testing for Social Security and Medicare. There are some great Tax Free Options that have very strong crediting options that in the past have outperformed the market. Here is an example of how the Index Strategy greatly outperformed the S&P 500 early on this century.

Look how much more money you would have had using the Index Crediting Method vs. being in the Market. Olshein Asset Advisors can show you the best way to manage your Retirement Savings.